I. Introduction

In the ever-evolving digital world, one term that has gained significant prominence in recent years is “cryptocurrency”. Over the past decade, it has emerged as a potent force shaking up the financial world, prompting discussions around our current monetary system. Let’s embark on a journey to decipher this digital enigma.

II. What is Cryptocurrency?

Cryptocurrency, as the name suggests, is a form of currency. However, unlike traditional currencies like the dollar or euro, it exists entirely in digital form. There are no physical notes or coins. Cryptocurrencies are also decentralized, which means they are not issued or regulated by a central authority, such as a government or financial institution.

The ‘crypto’ part of the term ‘cryptocurrency’ refers to the use of cryptography for security. Cryptography is a method of protecting information by transforming it into an unreadable format, known as encryption. It is this feature that makes cryptocurrencies secure and difficult to counterfeit.

Before we delve deeper into the dynamic world of digital currency, it’s essential to establish a solid understanding of what cryptocurrency is. Simply put, cryptocurrency is a form of digital or virtual currency that leverages cryptography for security. This technological advancement revolutionizes the concept of money by offering a decentralized form of exchange. Unlike traditional currencies issued and controlled by central banks, cryptocurrencies operate on networks called blockchains, which are decentralized and distributed across a vast number of computers worldwide.

-

Origin of Cryptocurrency

The inception of cryptocurrency was fuelled by the aspiration for a decentralized financial system. The concept took flight in 2008 when an individual or group under the pseudonym Satoshi Nakamoto released a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System”. This paper introduced the world to Bitcoin, the first cryptocurrency, laying the foundation for the surge of cryptocurrencies we witness today. Bitcoin showcased the potential of using a decentralized, peer-to-peer network to facilitate digital transactions, eliminating the need for intermediaries such as banks or financial institutions.

-

Cryptocurrency Vs. Traditional Money

To fully comprehend the essence of cryptocurrency, it’s helpful to draw comparisons with traditional money, also known as fiat currency. Fiat currencies, such as the US Dollar or Euro, are physical money controlled by central banks and governments. These entities have the power to issue new money and manage the supply to influence economic conditions.

In stark contrast, cryptocurrencies operate on a completely different framework. First, they’re entirely digital, with no physical coins or bills. Each unit of cryptocurrency represents a digital token. Second, cryptocurrencies are decentralized, meaning no single entity or institution has control over the entire network. This is possible due to the implementation of blockchain technology, where every transaction is recorded transparently and securely. Lastly, most cryptocurrencies have a limited supply. For instance, the total number of Bitcoins that will ever exist is capped at 21 million, a feature designed to counter inflation.

- In the next sections, we will explore how cryptocurrencies work, the technologies behind them, their types, uses, risks, and future implications, enabling you to navigate the world of digital money with confidence.

III. How Does Cryptocurrency Work?

Cryptocurrency’s operation is rooted in advanced technology and complex principles, but we can understand the basics once we break it down.

-

Blockchain and Decentralization

At the core of most cryptocurrencies is a technology known as blockchain. Blockchain is essentially a distributed ledger that records all transactions made with a particular cryptocurrency. It’s an immutable, chronological chain of blocks, with each block containing a list of transactions.

When a transaction occurs, it’s added to a block. Once a block is filled with transactions, it’s then verified by nodes (powerful computers participating in the network) and added to the chain of previous blocks, forming the blockchain.

The fascinating thing about blockchain is its decentralized nature. Unlike traditional banking systems, where transaction data is stored in a central server, blockchain data is distributed across a network of computers worldwide. This decentralization means there’s no central authority, and it also makes the system less vulnerable to attacks and manipulation. Once data is recorded on the blockchain, it’s very difficult to alter.

-

Understanding Mining

Mining is another fundamental concept in the functioning of cryptocurrencies. It refers to the process of validating and adding new transactions to the blockchain. In the context of cryptocurrency mining, miners are the nodes that verify the transactions.

When a transaction is initiated, miners use powerful computers to solve complex mathematical problems that validate the transaction’s details. The first miner to solve the problem gets the right to add the new block of transactions to the blockchain and is rewarded with a certain amount of cryptocurrency. This serves as an incentive for miners to participate in the validation process.

-

Role of Cryptography

Cryptography plays a crucial role in ensuring the integrity and security of transactions made with cryptocurrencies. Each transaction is encrypted into a complex code using cryptographic algorithms.

Moreover, users of cryptocurrencies have a pair of cryptographic keys: a public key, which is open to the public and serves as an address to which anyone can send cryptocurrencies, and a private key, which is kept secret by the owner and serves as a digital signature in the transaction process. This pair of keys ensures the security and authenticity of the transactions.

- This system enables the secure transfer of digital assets without the need for a trusted intermediary, such as a bank or payment processor. It’s this innovative combination of blockchain, mining, and cryptography that allows cryptocurrencies to operate as a decentralized digital currency system.

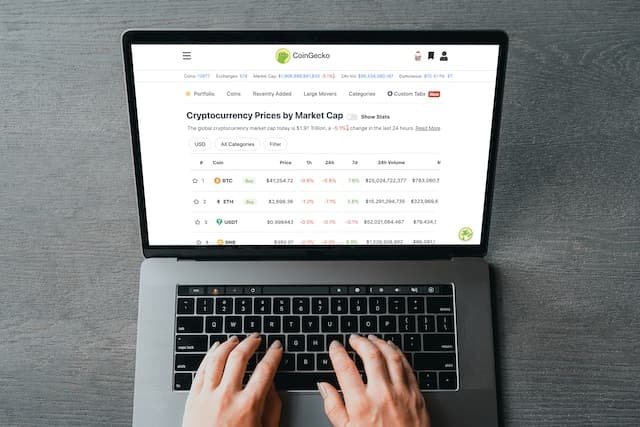

IV. Types of Cryptocurrencies

Cryptocurrencies have proliferated since the creation of Bitcoin, the first and most well-known cryptocurrency, in 2009. Today, there are over 10,000 different cryptocurrencies according to data from CoinMarketCap. These can be categorized into a few main types:

-

Bitcoin

Bitcoin, the first and most significant cryptocurrency, was developed by an anonymous person (or group of people) using the pseudonym Satoshi Nakamoto. Bitcoin introduced the concept of digital currencies and remains the most influential and valuable cryptocurrency in terms of market capitalization. Its primary purpose is to serve as a decentralized digital currency, without the need for a central authority.

-

Altcoins

The term ‘altcoin’ is a blend of ‘alternative’ and ‘coin’ and encompasses all cryptocurrencies other than Bitcoin. There are thousands of altcoins, and while some are quite similar to Bitcoin, many have introduced significant innovations and features.

- Ethereum (ETH): Ethereum is one of the most notable altcoins. It introduced the concept of smart contracts to the blockchain. Smart contracts are self-executing contracts with the agreement directly written into code, which allows for the creation of decentralized applications (dApps) and even other new cryptocurrencies.

- Litecoin (LTC): Created by Charlie Lee, Litecoin offers faster transaction confirmation times than Bitcoin and a different hashing algorithm.

- Ripple (XRP): Unlike many cryptocurrencies, Ripple aims to enhance real-time, cross-border payments for banks and other large financial institutions.

- Bitcoin Cash (BCH): Bitcoin Cash is a ‘fork’ of Bitcoin, created to allow for larger block sizes, thereby allowing for more transactions to be processed at once.

-

Tokens

Tokens represent a particular asset or utility and reside on their specific blockchain. Tokens can represent any assets that are fungible and tradeable, from commodities to loyalty points to even other cryptocurrencies. The process of creating tokens is much easier as you do not have to modify the codes from a particular protocol or create a blockchain from scratch. All you have to do is follow a standard template on the blockchain, such as on the Ethereum platform, which has made it popular for ICOs (Initial Coin Offerings) – a crowdfunding method in the crypto space.

-

Stablecoins

Stablecoins aim to combat the volatility of cryptocurrencies by tying their value to an external reference. Most commonly, this is a fiat currency like the US dollar, but it can also be commodities like gold or other cryptocurrencies. The idea is to combine the stability of traditional assets with the benefits of cryptocurrencies.

- Each type of cryptocurrency has its own unique features and benefits, and understanding these differences is essential for those interested in investing or using cryptocurrencies. As the landscape of digital currency continues to evolve, we can expect the emergence of even more types of cryptocurrencies.

V. Using Cryptocurrency

With an understanding of what cryptocurrency is, how it works, and its different types, the next logical step is to discuss how it’s used. The use of cryptocurrencies has evolved significantly over the years, and they’re now used for a wide range of purposes:

-

Online Transactions

The original and most direct use of cryptocurrencies is for digital transactions. Cryptocurrencies can be used to purchase goods and services online, with more and more businesses starting to accept them as a form of payment. Some of the largest online retailers and service providers that accept cryptocurrency include Overstock, Microsoft, and even PayPal. There are also specific online marketplaces, such as OpenBazaar, which exclusively accept cryptocurrencies.

-

Investment

Cryptocurrencies have quickly become popular as investment assets. Many people buy cryptocurrencies with the hope that their value will increase over time. The significant price increases of cryptocurrencies such as Bitcoin and Ethereum have fueled this view. However, it’s crucial to note that cryptocurrencies are extremely volatile, and investing in them involves substantial risk.

-

Fundraising for Projects

Cryptocurrencies have also become a popular way to raise funds for projects, particularly within the tech and startup communities. Initial Coin Offerings (ICOs), Security Token Offerings (STOs), and Initial Exchange Offerings (IEOs) are fundraising methods where companies or projects sell their own cryptocurrencies (often in the form of tokens) to investors to raise capital.

-

Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is a rapidly growing application of cryptocurrencies. DeFi aims to recreate traditional financial systems, like loans and interest, with cryptocurrencies, allowing for peer-to-peer financial systems without the need for intermediaries like banks. Services like Compound and Aave allow users to earn interest on their cryptocurrency holdings or take out loans using cryptocurrencies as collateral.

-

Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) are a type of cryptocurrency token that represents ownership of a unique item or piece of content. Unlike regular cryptocurrencies, which are interchangeable, or ‘fungible’, each NFT has a distinct value and specific information that cannot be replicated. This has made them particularly popular for associating digital ownership with physical assets or digital art.

- Whether you’re making online purchases, investing, or exploring DeFi, cryptocurrencies offer a host of opportunities for users. However, like any financial decision, using cryptocurrencies comes with certain risks, and these should be thoroughly understood before diving in.

VI. Risks and Challenges of Cryptocurrency

Despite the potential benefits and wide-ranging applications of cryptocurrencies, there are also significant risks and challenges associated with their use. It’s important to have a comprehensive understanding of these issues if you’re considering getting involved with cryptocurrencies:

-

Market Volatility

One of the most well-known characteristics of cryptocurrencies is their extreme volatility. The prices of cryptocurrencies can change rapidly in a very short time, making them possible high-reward – but also high-risk – investments. This volatility can result in significant financial losses if not managed properly.

-

Regulatory and Legal Risks

The legal status of cryptocurrencies varies significantly from country to country. Some nations have fully accepted cryptocurrencies, while others have imposed strict restrictions or outright bans. These uncertain and often changing regulatory landscapes present a considerable challenge for cryptocurrency users and businesses.

-

Security Risks

While the decentralized and encrypted nature of cryptocurrencies offers significant security benefits, they’re also associated with certain security risks. Cryptocurrency transactions are irreversible, so if your cryptocurrencies are stolen or your private key is lost, there’s typically no way to recover them. Cryptocurrency exchanges and wallets have also been targeted by hackers, leading to substantial financial losses for users.

-

Technological Challenges

The technology underpinning cryptocurrencies is still evolving and comes with its own set of challenges. Scalability issues, energy consumption, and a lack of user-friendly interfaces are some of the ongoing challenges faced by cryptocurrencies. These issues need to be resolved for cryptocurrencies to reach their full potential.

-

Adoption Challenges

For cryptocurrencies to become a mainstream method of payment, they need to be widely adopted by both consumers and businesses. However, fluctuating prices, regulatory concerns, and a lack of understanding about how cryptocurrencies work have limited their adoption to some extent.

- While cryptocurrencies offer numerous opportunities and have the potential to change many aspects of our lives, these risks and challenges are significant. It’s important for anyone considering using or investing in cryptocurrencies to be aware of these issues and to consider how they might be mitigated.

VII. Future of Cryptocurrency

Cryptocurrency’s journey is still in its early stages, despite the significant progress it has made since Bitcoin was first introduced in 2009. The future of cryptocurrency is uncertain and highly speculative; however, based on current trends and developments, here are some potential directions it might take:

-

Increased Adoption

One of the major expectations for the future of cryptocurrency is increased adoption. As more people become aware of cryptocurrencies and understand how to use them, it’s likely that their adoption will increase. This will be aided by further integration of cryptocurrencies into existing financial systems and more user-friendly cryptocurrency applications.

-

Greater Regulatory Clarity

The regulatory environment for cryptocurrencies is currently a patchwork, with significant variations between different countries and regions. However, as cryptocurrencies become more mainstream, it’s likely that we’ll see greater regulatory clarity. This could help to boost public trust in cryptocurrencies and make them a more viable option for both individuals and businesses.

-

Evolution of Technology

The technology underpinning cryptocurrencies will continue to evolve, leading to more efficient, secure, and scalable cryptocurrencies. We’re likely to see further developments in areas like smart contracts, DeFi, and NFTs, which could open up new possibilities for cryptocurrencies.

-

Integration into New Sectors

Cryptocurrencies have potential applications in a wide range of sectors. As the technology matures, we might see cryptocurrencies being integrated into areas like supply chain management, healthcare, and even governance. This could significantly change how these sectors operate, making them more efficient, transparent, and inclusive.

-

Decentralized Finance Expansion

Decentralized finance, or DeFi, is one of the most exciting developments in the cryptocurrency space. DeFi uses blockchain and cryptocurrencies to recreate traditional financial systems and institutions, like loans and interest, in a decentralized way. As the DeFi sector matures, it could potentially disrupt the traditional financial sector, offering people greater control over their finances and making financial services more accessible.

- While the future of cryptocurrency is uncertain, what’s clear is that it has the potential to bring about significant changes in our society. However, it also comes with challenges and risks, and it’s important that these are addressed as the sector continues to evolve.

VIII. Navigating the Crypto Future

As we’ve established, the world of cryptocurrency is an exciting and dynamic landscape with a plethora of opportunities and challenges. If you’re considering stepping into this domain, here are some tips to help you navigate the crypto future:

-

Educate Yourself

The first step is always to educate yourself. Cryptocurrency can be a complex subject to grasp, especially for those who are new to it. There are many resources available online and offline to help you understand the underlying technology, its applications, and the risks involved. Use them to your advantage.

-

Understand the Risks

Cryptocurrencies are highly volatile and investing in them can be risky. Ensure that you have a clear understanding of these risks before you decide to invest. It’s also recommended that you don’t invest more money than you can afford to lose.

-

Secure Your Investments

Security is a critical aspect of dealing with cryptocurrencies. As digital assets, they are susceptible to hacking and theft. Ensure you store your cryptocurrencies in secure wallets, use strong passwords, and enable two-factor authentication wherever possible.

-

Stay Updated

The world of cryptocurrencies is always evolving, with new developments occurring almost every day. Make sure to stay updated with the latest news and trends. Follow reliable news sources, join online communities, and participate in discussions and forums.

-

Diversify Your Portfolio

If you decide to invest in cryptocurrencies, consider diversifying your investment portfolio. Like any investment, it’s not wise to put all your eggs in one basket. Investing in a mix of cryptocurrencies can help spread your risk.

-

Be Patient and Think Long-Term

The price of cryptocurrencies can be highly volatile in the short term. If you’re investing, consider adopting a long-term perspective. While there can be tempting opportunities for quick profits, these often come with high risks.

-

Consider Professional Advice

If you’re unsure about anything, don’t hesitate to seek professional advice. Financial advisors, particularly those with experience in cryptocurrencies, can provide valuable guidance and help you make informed decisions.

- Entering the world of cryptocurrency is an exciting journey. It’s a path that’s being paved with countless opportunities, but also one that comes with its fair share of bumps. However, with the right approach, you can navigate this path successfully and make the most of what cryptocurrencies have to offer.

IX. Glossary of Key Cryptocurrency Terms

Understanding the complex world of cryptocurrencies requires becoming familiar with a range of specific terms and jargon. Here are some key terms to help you navigate conversations and readings about cryptocurrencies:

-

Bitcoin

Bitcoin is the first and most well-known cryptocurrency, introduced by an anonymous entity known as Satoshi Nakamoto. Bitcoin operates on a decentralized network called a blockchain.

-

Blockchain

A blockchain is a decentralized, distributed ledger that records the origin and ownership of a digital asset, like a cryptocurrency. It is composed of a chain of blocks, each holding a list of transactions.

-

Altcoin

An altcoin is any digital cryptocurrency similar to Bitcoin. The term is said to stand for “alternative to Bitcoin” and is used to describe any cryptocurrency that isn’t Bitcoin.

-

Ethereum

Ethereum is an open-source, blockchain-based platform that enables developers to build and deploy decentralized applications (dApps). Its native cryptocurrency is called Ether (ETH).

-

Cryptocurrency Wallet

A cryptocurrency wallet is a secure digital wallet used to store, send, and receive digital currency like Bitcoin.

-

Mining

Mining is a process where powerful computers perform complex calculations to validate and record transactions on a cryptocurrency’s blockchain. Miners are rewarded with new units of cryptocurrency.

-

Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is a financial system built on blockchain technologies and cryptocurrency. It aims to recreate and improve upon the existing financial system, removing intermediaries and offering open access to financial services.

-

Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) are a type of digital asset created using blockchain technology. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a like-for-like basis, NFTs are unique and can represent ownership of a specific item or piece of content.

-

Initial Coin Offering (ICO)

An Initial Coin Offering (ICO) is a fundraising method that trades future crypto coins for cryptocurrencies which have an immediate, liquid value. Essentially, it’s a form of crowdfunding in the cryptocurrency world.

-

Smart Contract

A smart contract is a self-executing contract where the terms of the agreement are written directly into code. They run on the blockchain and operate without the need for a middleman.

- As you delve deeper into the world of cryptocurrencies, you’ll encounter many more terms. Keeping this glossary handy can help you understand and participate in discussions about this groundbreaking technology and its applications.

Frequently Asked Questions

- What is Cryptocurrency?

- Cryptocurrency is a form of digital or virtual currency that uses cryptography for security. Unlike traditional currencies, it operates autonomously without a central authority. Cryptocurrencies like Bitcoin, Ethereum, and many others offer a new way to conduct transactions over the internet.

- How Does Cryptocurrency Work?

- Cryptocurrency works using a technology called blockchain. Blockchain is a decentralized ledger that records all transactions across a network. Transactions are added to the blockchain through a process called mining, where powerful computer systems solve complex mathematical problems to validate each transaction. Once a transaction is validated and added to the blockchain, it can’t be changed or removed, which contributes to the security and transparency of the cryptocurrency system.

- What are the risks associated with cryptocurrency?

- Some of the main risks include market volatility, security concerns due to possible digital breaches, and the complex and often uncertain regulatory landscape. The value of a cryptocurrency can fluctuate wildly, and while the blockchain itself is secure, wallets and exchanges can be vulnerable to hacks. Moreover, different countries have different rules about how to handle cryptocurrencies, which can make navigating the legal implications challenging.

- What are the different types of Cryptocurrencies?

- Bitcoin, introduced in 2009, was the first cryptocurrency and remains the most well-known. However, there are thousands of different cryptocurrencies, collectively known as altcoins. Some of the most prominent altcoins include Ethereum, which introduced smart contracts, and Litecoin, which offers faster transaction times than Bitcoin. There are also tokens, which represent assets or utility within a specific blockchain ecosystem.

- How can Cryptocurrency be used?

- Cryptocurrency can be used in various ways. Many people buy cryptocurrencies as an investment, hoping that their value will go up. Cryptocurrencies can also be used to buy goods and services, both online and in physical stores. Furthermore, the underlying technology, blockchain, has a wide range of uses beyond cryptocurrencies, including supply chain tracking, secure sharing of medical records, and even voting systems.

Comments 2