Introduction: Unveiling the Bitcoin Phenomenon

Bitcoin, the first cryptocurrency, emerged as a groundbreaking innovation in the world of finance and technology. As a decentralized digital currency, it has revolutionized the way we think about money. This article delves deep into the facets of Bitcoin, exploring its history, technology, and the impact it has had since its inception.

Table of Contents

ToggleSection 1: The Genesis of Bitcoin

Unraveling Bitcoin’s Mysterious Origins

The enigmatic creation of Bitcoin in 2009 by Satoshi Nakamoto, a pseudonym for an unknown individual or group, heralded a revolution in digital finance. The release of the Bitcoin white paper was a pivotal moment, introducing the world to a decentralized system designed to circumvent the double-spending problem. This paper proposed an ingenious solution – a peer-to-peer network that eliminated the need for any central authority, a radical departure from traditional financial systems.

The white paper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” detailed a method for allowing digital transactions to be made directly from one party to another without going through a financial institution. This was achieved through the innovative use of blockchain technology, a concept that would become a cornerstone of all cryptocurrencies.

The Groundbreaking Technology Behind Bitcoin

Blockchain: The Foundation of Bitcoin

The blockchain is essentially a public ledger, a transparent and tamper-proof system where all Bitcoin transactions are recorded. It operates on a consensus mechanism, ensuring that each transaction is validated by multiple participants in the network. This approach not only maintains the integrity of the transaction data but also enhances security, as altering any information on the blockchain would require changing all subsequent blocks, an almost impossible feat.

Solving the Double-Spending Problem

A significant challenge in digital currencies is the risk of double-spending, where the same digital token could be spent more than once. Bitcoin’s blockchain technology effectively resolves this issue by ensuring that once a transaction is added to the ledger, it cannot be duplicated or reversed, thereby preventing fraud.

The Early Days of Bitcoin

Bitcoin’s journey from an obscure digital project to a globally recognized currency was not instantaneous. Its early days were characterized by skepticism from financial experts and a slow but steady growth in user adoption.

The First Bitcoin Transaction

In a now-legendary event, on May 22, 2010, a programmer named Laszlo Hanyecz made the first real-world transaction using Bitcoin. He purchased two pizzas for 10,000 BTC, a transaction that is celebrated annually as “Bitcoin Pizza Day.” the value of these Bitcoins was approximately $41, a stark contrast to their worth today, showcasing the dramatic appreciation of Bitcoin’s value over time.

Growing Acceptance and Milestones

Despite initial doubts, Bitcoin began to gain traction. The establishment of the first Bitcoin exchange, the development of mining pools, and the creation of more user-friendly wallets all contributed to its gradual acceptance. Each of these developments represented a significant milestone in Bitcoin’s journey, enhancing its accessibility and usability.

In July 2010, the launch of Mt. Gox, one of the first Bitcoin exchanges, marked a significant step in Bitcoin’s journey, offering a platform for users to buy and sell Bitcoin. This development played a crucial role in establishing a market price for Bitcoin, leading to increased visibility and interest.

The mining landscape also evolved during this period. The creation of mining pools, where miners combined their computational resources to increase their chances of earning Bitcoin, became a popular method. This collaborative approach not only made mining more accessible but also contributed to the network’s stability and security.

Bitcoin’s Early Challenges and Resilience

Navigating Technical and Security Issues

Bitcoin’s early years were not without challenges. The network faced various technical and security issues, including a significant vulnerability in 2010 that led to the creation of billions of unauthorized Bitcoins. However, the quick response and resolution of this issue by the Bitcoin community demonstrated the resilience and adaptability of the network.

Overcoming Public Perception and Regulatory Hurdles

Public perception of Bitcoin in its initial years ranged from skepticism to outright dismissal. Concerns over its use for illicit transactions and the lack of regulatory clarity posed significant challenges. However, Bitcoin’s community and developers continued to work on improving its technology and advocating for its potential as a decentralized currency.

Section 2: Understanding Bitcoin Technology

Deciphering Blockchain Technology

At the heart of Bitcoin lies blockchain technology, a transformative and innovative approach to data management and security. This decentralized ledger system has redefined how digital transactions are recorded and verified, offering a level of transparency and security unparalleled in traditional financial systems.

The Structure and Function of Blockchain

Blockchain comprises a series of blocks, each containing a list of transactions. Every new block created is linked to the previous one, forming a continuous and unbreakable chain. This linkage ensures that once data is entered into the blockchain, it becomes nearly impossible to alter, thereby safeguarding the integrity of the entire system.

Decentralization: The Core of Blockchain’s Security

Unlike traditional banking systems, where a single entity controls the ledger, blockchain is maintained by a network of computers, known as nodes. Each node has a copy of the entire blockchain, and they work collectively to verify and record new transactions. This decentralization not only eliminates the risk of a single point of failure but also makes the system more resistant to fraudulent activities.

The Mechanics of Bitcoin Transactions

Bitcoin transactions represent the core functionality of this digital currency, enabling users to transfer value in a secure and efficient manner.

How Transactions Work in the Bitcoin Network

A Bitcoin transaction begins when a user decides to transfer Bitcoin to another. The transaction details, including the sender’s and receiver’s wallet addresses and the amount of Bitcoin being transferred, are broadcast to the network. This information is then verified by network participants (miners) and added to a new block on the blockchain.

The Role of Cryptographic Techniques

Security in Bitcoin transactions is upheld through the use of cryptographic techniques. Each user has a pair of cryptographic keys: a public key, which is shared openly and acts as an address to receive Bitcoin, and a private key, which is kept secret and used to sign transactions. The use of these keys ensures that only the rightful owner of the Bitcoin can spend it.

Ensuring Transaction Integrity and Privacy

While Bitcoin transactions are transparent and traceable on the blockchain, they also offer a degree of privacy. The public keys used in transactions do not directly reveal the identity of the users involved, ensuring a level of anonymity. However, the complete record of transactions on the blockchain allows for transparency and traceability, a unique balance that has been one of the key attractions of Bitcoin.

Innovations in Bitcoin’s Transaction Processing

Enhancing Scalability and Speed

One of the challenges in the Bitcoin network has been scalability and the speed of transaction processing. Innovations like the Lightning Network have been developed to address these issues. This technology allows for faster transactions by creating off-chain payment channels, significantly reducing the time and fees associated with Bitcoin transactions.

Smart Contracts and Bitcoin

While not inherent to Bitcoin’s original design, the concept of smart contracts has been integrated into the blockchain ecosystem. These are self-executing contracts with the terms of the agreement directly written into code, allowing for more complex and automated transactions within the blockchain framework.

Section 3: The Mining Process

What is Bitcoin Mining?

Bitcoin mining is the backbone of the Bitcoin network, a process crucial for maintaining the ledger’s integrity and introducing new Bitcoins into circulation. Miners contribute computational power to validate and record transactions on the blockchain, a task that demands considerable processing power and energy.

The Role of Miners in the Network

Miners are essentially the auditors of the Bitcoin network. They perform the critical task of confirming the legitimacy of Bitcoin transactions. This verification process prevents the issue of double-spending, where the same Bitcoin could be spent more than once. For their efforts, miners are rewarded with newly minted Bitcoins and transaction fees.

The Mining Reward and Halving Events

The reward for mining a block started at 50 Bitcoins and halves approximately every four years, an event known as “halving.” As of my last update in April 2023, the reward stands at 6.25 Bitcoins per block. This halving mechanism ensures that the total number of Bitcoins never exceeds 21 million, making Bitcoin a deflationary asset.

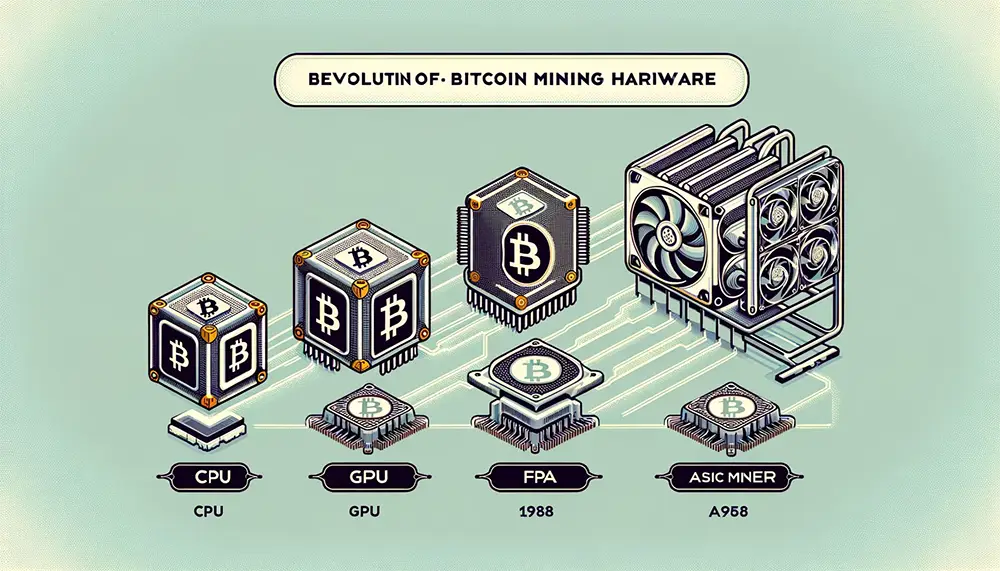

Bitcoin Mining Software and Hardware

The evolution of Bitcoin mining technology mirrors the growing complexity and scale of the Bitcoin network.

From CPU to ASIC: The Evolution of Mining Hardware

In the early days, Bitcoin mining could be done using a regular CPU. However, as the network grew, so did the difficulty of the mining process. This led to the adoption of more powerful GPUs (Graphics Processing Units), followed by FPGAs (Field-Programmable Gate Arrays), and ultimately ASICs (Application-Specific Integrated Circuits). Today, ASIC miners are the standard, designed specifically for Bitcoin mining.

Mining Software: The Brain Behind the Operation

Complementing the hardware are sophisticated mining software solutions. These programs connect the miners to the blockchain and the mining pool, if they are part of one. The software is responsible for delivering the work to the miners, receiving the completed work, and adding the information back to the blockchain. Advanced software also allows miners to monitor the performance of their hardware, including temperature, hash rate, and average mining speed.

The Challenges and Sustainability of Bitcoin Mining

Energy Consumption and Environmental Concerns

One of the most discussed aspects of Bitcoin mining is its energy consumption. The process is energy-intensive due to the computational power required. This has raised concerns about the environmental impact of Bitcoin mining, leading to debates and research into more sustainable energy sources.

The Shift Towards Renewable Energy

In response to environmental concerns, there is a growing trend in the mining community towards the use of renewable energy sources. Solar, wind, and hydroelectric power are becoming more prevalent in Bitcoin mining operations, aiming to reduce the carbon footprint associated with the mining process.

Section 4: Bitcoin in the World Economy

Bitcoin’s Impact on Financial Markets

Bitcoin’s emergence has significantly reshaped the landscape of global financial markets. Its unique attributes – decentralization, limited supply, and being the first of its kind – have made it a subject of great interest and speculation.

Bitcoin as an Investment Asset

Bitcoin has increasingly become a popular asset in investment portfolios, often compared to gold as a potential store of value or “digital gold.” Its price volatility, while a source of risk, also presents opportunities for substantial gains, attracting a diverse range of investors from individuals to institutional players.

Influence on Market Sentiment and Investment Strategies

The rise of Bitcoin has introduced new dynamics in financial markets. Its price movements often influence market sentiment, impacting the investment strategies of both crypto and traditional investors. This has led to the development of various financial products around cryptocurrencies, including futures contracts and exchange-traded funds (ETFs).

Legal and Regulatory Landscape

The legal and regulatory environment for Bitcoin varies significantly across the globe, reflecting the diverse perspectives of governments and financial authorities.

Global Regulatory Perspectives

In some countries, Bitcoin is welcomed and regulated similarly to other financial instruments, with guidelines for its use and taxation. In contrast, other nations have imposed strict regulations or outright bans, citing concerns over financial stability, money laundering, and investor protection.

The Evolving Nature of Bitcoin Regulation

Regulatory bodies worldwide are continually adapting their policies to accommodate the growing prominence of Bitcoin while addressing associated risks. This includes efforts to develop clear regulatory frameworks, consumer protection laws, and anti-money laundering (AML) and know-your-customer (KYC) requirements specific to cryptocurrency transactions.

Bitcoin’s Role in Global Remittances and Transactions

Facilitating Cross-Border Transactions

One of Bitcoin’s notable contributions to the world economy is its role in simplifying and reducing the cost of cross-border transactions. Unlike traditional banking systems, Bitcoin allows for faster and more cost-effective international transfers, making it an appealing option for remittances and global trade.

Impact on Emerging Economies

In emerging economies, where access to traditional banking services is limited, Bitcoin offers an alternative financial tool. It provides a means for financial inclusion, allowing individuals and businesses to engage in the global economy more directly.

Section 5: The Future of Bitcoin

Bitcoin Predictions and Trends

The future of Bitcoin, while promising, is shrouded in uncertainties due to its inherent volatility. Experts and analysts use a variety of methods to forecast its direction, examining market trends, investor behaviors, and technological developments.

Market Trends and Investor Sentiment

Market trends in Bitcoin are closely watched, as they can offer insights into potential future movements. Factors like global economic conditions, regulatory changes, and technological advancements play significant roles in shaping investor sentiment. For instance, increased institutional investment in Bitcoin could signal greater mainstream acceptance, potentially stabilizing its price.

Technological Advancements and Their Impact

The continuous evolution of technology within the Bitcoin ecosystem directly impacts its future prospects. Developments in blockchain efficiency, transaction speed, and security protocols are crucial in determining Bitcoin’s usability and scalability, key factors for its long-term success.

Innovations and Future Technology

The Bitcoin network is in a constant state of evolution, with ongoing innovations aiming to address its current limitations and expand its potential applications.

Scaling Solutions and Network Upgrades

One of the significant challenges facing Bitcoin is scalability. Solutions like the Lightning Network aim to increase transaction throughput while maintaining security and decentralization. Future network upgrades and innovations are expected to further enhance Bitcoin’s performance and user experience.

Integration of Bitcoin into Traditional Finance

There is a growing trend of integrating Bitcoin with traditional financial systems. This includes the development of Bitcoin-based financial products, such as ETFs and derivatives, which could lead to increased adoption by mainstream investors and institutions.

Advancements in Security and Privacy

Security and privacy remain at the forefront of Bitcoin’s technological advancements. With increasing attention on data privacy and cybersecurity, future developments in cryptographic techniques and blockchain security are anticipated to strengthen Bitcoin’s position as a secure digital currency.

Bitcoin’s Role in the Future of Money

Potential for Widespread Adoption

As digital currencies become more accepted, Bitcoin’s potential for widespread adoption grows. Its decentralized nature and the possibility of providing financial services to the unbanked are particularly compelling aspects that could drive its future growth.

Challenges and Opportunities Ahead

While Bitcoin faces challenges such as regulatory uncertainty and environmental concerns, it also presents numerous opportunities. Its ability to innovate and adapt will be key in shaping its role in the future of money and finance.

Section 6: Notable Personalities in the Bitcoin Space

Key Figures and Their Contributions

The story of Bitcoin is not just about technology; it’s also about the people who helped shape it. Several key individuals have played crucial roles in its development and growth, contributing to both the technical aspects and the wider acceptance of this groundbreaking cryptocurrency.

Satoshi Nakamoto: The Mysterious Founder

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, remains one of the most intriguing figures in the cryptocurrency space. Nakamoto’s 2008 white paper laid the groundwork for Bitcoin and introduced blockchain technology to the world. Despite numerous speculations, Nakamoto’s true identity remains unknown, adding a layer of mystique to Bitcoin’s story.

Hal Finney: Early Developer and Bitcoin’s First Recipient

Hal Finney, a renowned cryptographer and programmer, was one of the first contributors to Bitcoin’s code after Satoshi Nakamoto. Finney is famously known for being the recipient of the first Bitcoin transaction, sent by Nakamoto. His early experiments and feedback were pivotal in the initial development of the Bitcoin network.

Nick Szabo: The Concept of Smart Contracts

Nick Szabo, a computer scientist and cryptographer, is known for his research in digital contracts and digital currency. He developed the concept of “smart contracts,” which would later become a foundational aspect of blockchain technology. Though he has been speculated as a potential candidate for Satoshi Nakamoto, Szabo has consistently denied these claims.

Winklevoss Twins: Bitcoin Entrepreneurs and Advocates

Cameron and Tyler Winklevoss, known for their legal battle with Mark Zuckerberg over the founding of Facebook, became early investors in Bitcoin. They founded Gemini, a cryptocurrency exchange, and have been vocal advocates for Bitcoin and digital currencies, significantly influencing public perception and investor interest.

The Impact of Visionary Leaders

Shaping the Future of Finance

These personalities, among others, have not only contributed to the technological underpinnings of Bitcoin but have also been instrumental in advocating for its potential to transform financial systems. Their visions and innovations continue to inspire ongoing development in the cryptocurrency space.

Building a Community and Ecosystem

Beyond their technical contributions, these figures have helped build a robust community and ecosystem around Bitcoin. This community has been crucial in driving adoption, navigating regulatory challenges, and fostering continuous innovation in the space.

Section 7: Practical Guide to Bitcoin

How to Start with Bitcoin

Entering the world of Bitcoin can be exciting, but it’s essential to understand the basics. Here’s a simple guide for those new to this digital currency.

Setting Up a Digital Wallet

The first step in using Bitcoin is to set up a digital wallet. This wallet stores your Bitcoin and is used to send, receive, and manage your cryptocurrency. There are several types of wallets available, including hardware wallets, software wallets, and mobile wallets. Each type offers different levels of security and convenience, so choose one that best suits your needs.

Understanding Basic Security Protocols

Security is paramount when dealing with cryptocurrencies. Always keep your private keys confidential, use strong, unique passwords for your wallet, and consider using two-factor authentication (2FA) for additional security. Remember, in the world of Bitcoin, security is your responsibility.

Purchasing Bitcoin

You can purchase Bitcoin through various channels, including cryptocurrency exchanges, Bitcoin ATMs, or peer-to-peer platforms. When using exchanges, ensure they are reputable and provide adequate security measures. It’s also advisable to start with small transactions as you familiarize yourself with the process.

Real-world Use Cases of Bitcoin

Bitcoin’s application extends far beyond just being a digital investment asset. Its real-world uses are continually expanding.

Online Transactions and Shopping

Many online retailers and service providers now accept Bitcoin as a form of payment. This trend is growing as Bitcoin offers a secure, quick, and often more cost-effective method for transactions, especially in international commerce.

International Remittances

Bitcoin is increasingly used for international remittances due to its low transaction fees and fast processing times. It’s particularly beneficial for those who do not have access to traditional banking services, providing a lifeline for transferring funds across borders.

Brick-and-Mortar Establishments

An increasing number of physical stores are beginning to accept Bitcoin. From cafes to retail stores, Bitcoin is making its way into everyday transactions, demonstrating its growing acceptance and versatility.

Conclusion: Bitcoin’s Enduring Legacy and Future Prospects

Bitcoin’s journey from an obscure digital currency to a widely recognized financial asset is a testament to the power of innovation and technology. As the first cryptocurrency, it has not only paved the way for others but has also shown the potential of blockchain technology in transforming traditional financial systems. Looking forward, Bitcoin continues to represent not just a form of digital currency, but a symbol of the evolving landscape of finance and technology.

Frequently Asked Questions

- What is Bitcoin and how does it work?

Bitcoin is a digital currency that operates on a decentralized network of computers. It uses blockchain technology to record transactions, which are secured using cryptographic techniques. Bitcoin is not controlled by any central authority, making it a peer-to-peer system where transactions happen directly between users. - How do you mine Bitcoin?

Mining Bitcoin involves using powerful computers to solve complex mathematical problems that validate and record transactions on the blockchain. Successful miners are rewarded with new Bitcoins and transaction fees. This process requires significant computational power and electricity. - Is Bitcoin legal?

The legality of Bitcoin varies by country. In some countries, Bitcoin is legal and regulated similarly to other currencies, while in others, it faces strict regulations or is outright banned. It’s essential to check the legal status of Bitcoin in your specific country. - Can Bitcoin be converted to cash?

Yes, Bitcoin can be converted to cash. This is typically done through cryptocurrency exchanges where you can sell your Bitcoin for traditional currency, which can then be withdrawn to your bank account. There are also Bitcoin ATMs in some cities that allow you to exchange Bitcoin for cash. - What can you buy with Bitcoin?

The range of items you can buy with Bitcoin is continually expanding. It includes online goods and services, gift cards, and even real estate. Some brick-and-mortar stores also accept Bitcoin, and it’s increasingly used for international remittances. - How does Bitcoin differ from traditional currencies?

Unlike traditional currencies, Bitcoin is decentralized, meaning it is not controlled by any central bank or government. It’s purely digital and uses cryptography for security. Its supply is also limited, with a maximum of 21 million Bitcoins that can ever exist, unlike fiat currencies which can be printed.

Thank you for taking the time to read our article! We sincerely hope you found it informative and insightful. Your interest and engagement are truly appreciated. If you have any thoughts or questions about the topic, feel free to share them. Again, thank you for joining us on this exploration of Bitcoin and its fascinating journey. Stay tuned for more articles like this!